Summary

- UPL had an important Q3 2014, as it shifted its natural gas production mix by acquiring additional Pinedale assets and divesting from the Marcellus in an attempt to increase margins.

- Management appears to understand the possibility of further oil and natural gas price drops.

- UPL's stock price decreased 56% in the last 6 months, compared to a 49% drop in WTI and 34% drop in natural gas.

- As one of the low cost producers of natural gas, Ultra Petroleum is well positioned against its competitors going forward with potential downside of 16% vs potential upside of 50%+.

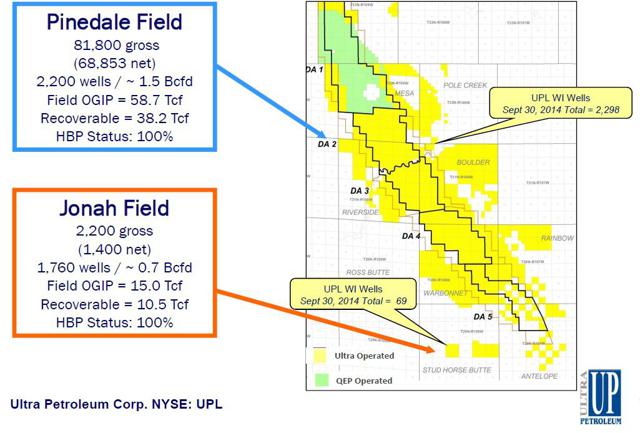

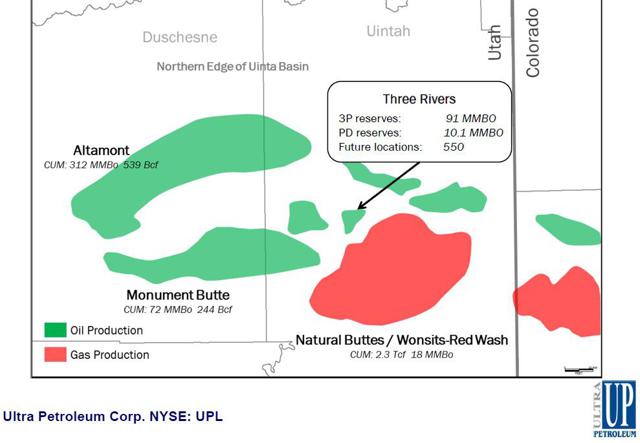

Ultra Petroleum Corp (NYSE: UPL) is an independent oil and natural gas (O&G) company involved in the exploration and production (E&P), development, operation, and acquisition of oil and gas interests. The Company's main activities are developing natural gas reserves in: the Green River Basin of Wyoming - the Pinedale and Jonah fields, oil reserves in the Uinta Basin in Utah, and natural gas reserves in the Appalachian Basin of Pennsylvania.

Additionally, Ultra Petroleum conducts a majority of its O&G activities jointly with others. The Company's revenues primarily derive from the production and sale of natural gas and condensate in southwest Wyoming, in addition to a smaller portion of the Company's revenues coming from oil sales in the Uinta Basin in Utah, and gas sales from wells in the Appalachian Basin in Pennsylvania.

Q3 2014 Update

During Q3 2014, the Company realized an average natural gas price of $3.59 per Mcf, including realized gains and losses on commodity derivatives, compared with $3.41/Mcf during Q3 2013. Moreover, the average realized price excluding gains and losses on commodity derivatives was $3.72/Mcf, compared with $3.44/Mcf during Q3 2013.

No comments:

Post a Comment